Comprehending The Thorough Conditions In Lending Agreements Without Credit Check

Write-Up By-Ralston Mercer

When it pertains to agreements, agreements and financial products like no debt check loans with triple-digit rate of interest and short payment terms, fine print can be difficult to comprehend. This typically results in misconceptions and unexpected consequences.

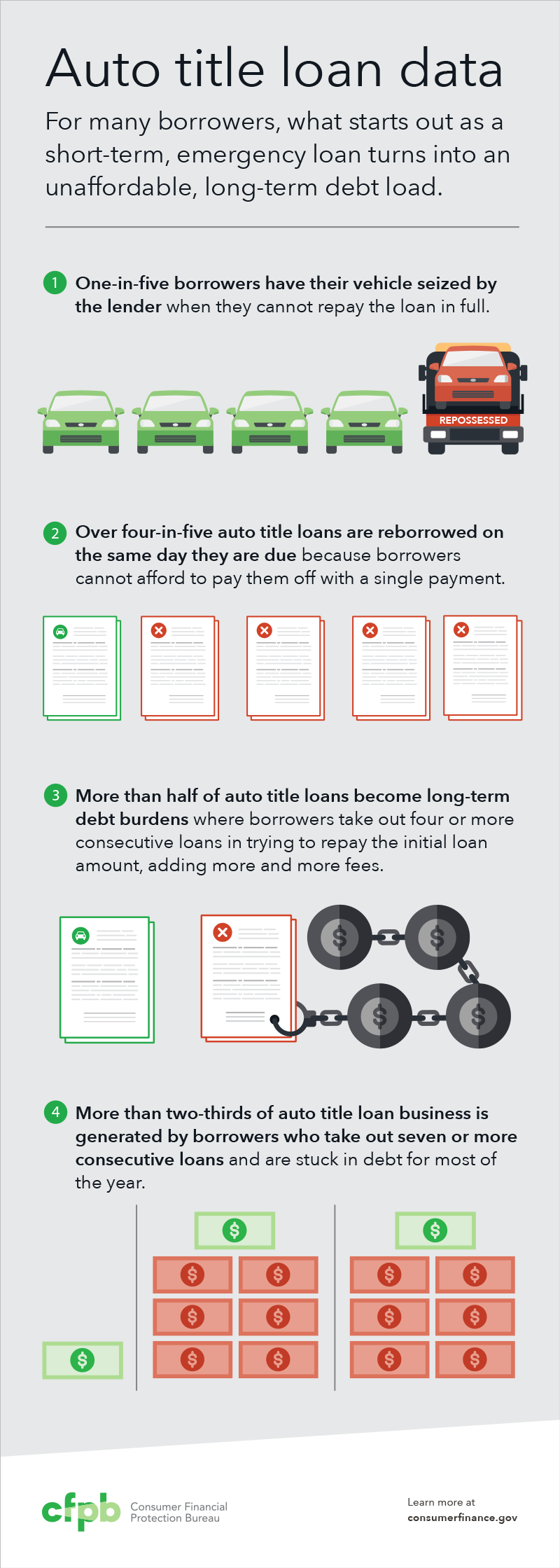

No-credit-check funding options like cash advance and title car loans can cause unmanageable debt, triggering many people to become caught in a cycle of economic injury.

1. Interest Rates

If you need cash money promptly however have a low credit rating or erratic repayment history, no-credit-check loans may seem attractive. However, loan providers that provide these lendings usually charge high rate of interest and costs. Before getting among these funding alternatives, think about inspecting personalized rates from multiple loan providers. A hard credit history inquiry needs your permission, shows up on your credit score record and can lower your credit report. Alternatives to no-credit-check lendings consist of small business loan, credit union loans, unprotected personal fundings and "acquire currently, pay later on" financing apps.

No-credit-check loans generally aren't implied to be lasting funding options and ought to just be made use of for emergency costs, like medical bills or home fixings. These kinds of fundings usually have brief payment periods, and debtors are required to make their payments around cash advance or their following scheduled paycheck. Some loan providers check a consumer's capacity to repay by evaluating their bank accounts, conducting a soft credit pull or requesting for proof of earnings.

2. Costs

There are several loan providers that provide individual lendings with or without a credit scores check. Unlike cash advance and title fundings, these borrowing options commonly have affordable rate of interest. In visit the following web site , much of these finances can be made use of for a large range of expenses.

No matter what sort of loan you are making an application for, it is essential to comprehend the loan provider's conditions prior to accepting any kind of funding arrangement. This consists of analysis and understanding the small print of the loan contract, as well as paying very close attention to fees and settlement quantities.

It is additionally a good idea to compare the rates and terms of a number of loan providers before choosing. Make sure to take into consideration not only the interest rate but also any kind of costs connected with the financing, such as late costs or insufficient funds costs. In addition, it is an excellent idea to compare the maximum loaning amounts with each lending institution. This can aid you stay clear of going over your maximum line of credit.

3. Repayment Terms

While no credit report check fundings may look like a financial lifeline for those with poor scores, they can rapidly turn into financial obligation catches with outrageous rates of interest and brief settlement durations. While these loan items are usually readily available in the event of emergency, it is best to meticulously examine your demands, compare lending institutions and their rates, and fully recognize all of the terms before getting one.

Instead of pulling your credit scores record, some no-credit-check lenders utilize alternate techniques to establish your capability to repay the car loan. These can consist of assessing your checking account, doing a soft credit report pull, checking various other credit scores bureaus, and requiring proof of revenue. It is also important to find out if the lender will certainly report your settlements to the credit rating bureaus.

If you are taking into consideration a no-credit-check funding, ask the lender to offer an amortization routine. This will certainly highlight just how your month-to-month payment is allocated between the principal, interest, and costs.

4. https://zenwriting.net/kate215alexa/introducing-the-reality-about-no-credit-scores-inspect-financings-what

Although it's not recommended to obtain no credit report check fundings (unless you're an armed forces servicemember and have been given home loan forbearance because of financial difficulty), if you find yourself behind the eight ball, a temporary funding may be practical. However, it is essential to recognize the conditions of any kind of financings you take out-- specifically the rate of interest, charges and settlement terms. APRs for no-credit-check lendings are normally greater than those of conventional individual loans, and some lending institutions might charge too much fees or consist of brief repayment terms that make it difficult to fulfill the obligations. Payday advance and car title loans are common sorts of no-credit-check finances.

Alternatives to these sorts of financings consist of safeguarded charge card and home equity lines of credit, as well as home mortgage forbearance.